8 Ways You Could Be Financially Better Off in 2025

What can Australians expect in 2025? According to Canstar, several upcoming changes are set to ease cost of living pressures and provide financial relief for millions of households. Here’s how you may benefit in the new year:

1.Rate Cuts

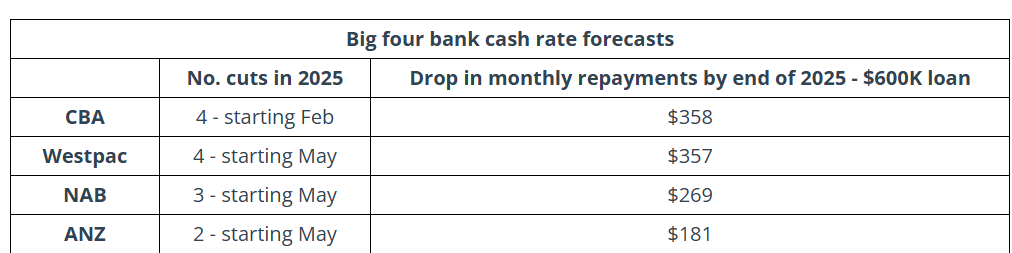

While interest rate cuts aren’t certain, they’re highly likely, with major banks forecasting reductions in 2025. Even just two rate cuts could lower a typical borrower’s monthly repayment by $181 on a $600,000 loan.

2. Increased Support Payments

From January 2025, a range of support payments, including Youth Allowance, Austudy, and Carer Allowance, will increase in line with inflation, providing financial relief for eligible recipients.

3. Pay Rise for Aged Care Workers

In 2025, eligible aged care workers will see a pay rise, with minimum wage rates increasing for various roles, including direct care workers, general care staff, and aged care employees. This pay boost aims to improve compensation in the sector, reflecting the essential contributions these workers make to society.

4. Higher Medicare Safety Net

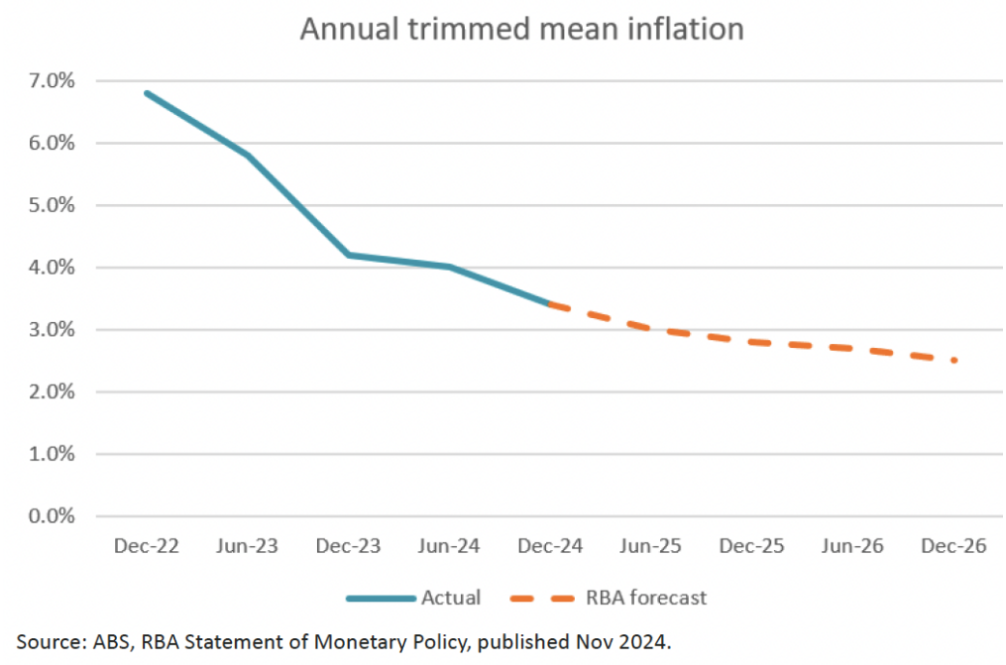

5.Easing Inflation

6. Health Insurance Extras Reset

Many health insurance funds will reset members’ annual extras limits in January. It’s a good time to assess whether your policy still meets your needs and consider switching if necessary.

7. Help to Buy Scheme for First Home Buyers

The new “Help to Buy” scheme will assist lower-income first home buyers by allowing them to co-purchase a property with the government with a 2% deposit. This scheme will be available to 40,000 people over four years, pending state legislation.

8.Superannuation Paid on Parental Leave

From July 2025, eligible parents on government-funded Parental Leave Pay will receive superannuation contributions. Additionally, the Superannuation Guarantee will rise to 12% in July.

Conclusion

Some data insights director, Sally Tindall, explains that while 2024 has been challenging financially for many, 2025 should offer some relief. While interest rate cuts aren’t guaranteed, when they do happen, homeowners can take advantage by refinancing or negotiating better rates. For those receiving government support, the increase in payments will provide much-needed relief, though it won’t fully offset rising costs. The Help to Buy scheme, once launched, will offer lower-income first-home buyers a way into the market. Tindall recommends setting financial goals for 2025, so you’re prepared to make the most of any opportunities that arise.