Australian Real Estate Market Prediction for 2025: Essential Details in a Simplified Style

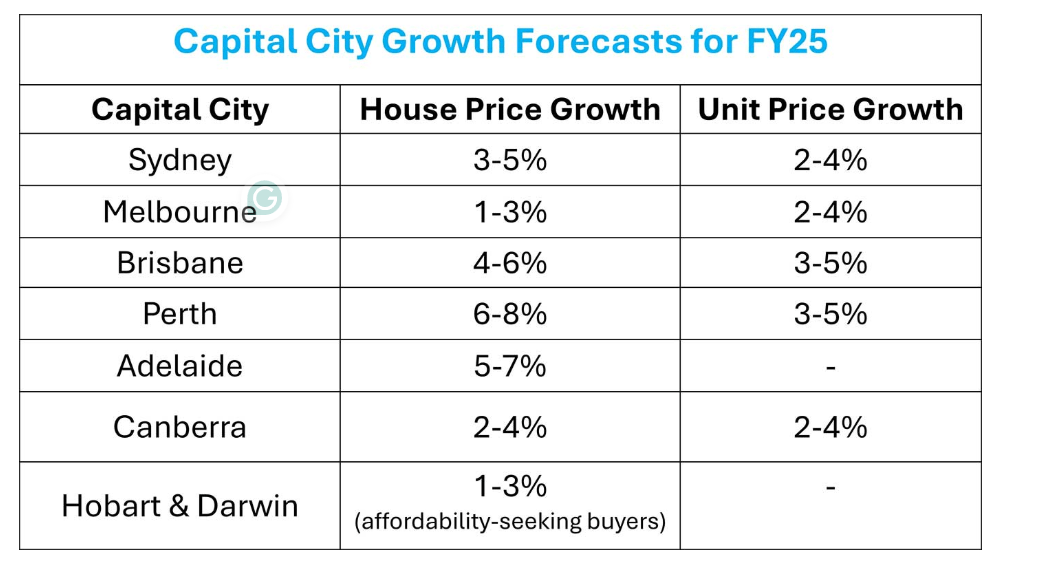

As we move into 2025, Australia’s property market remains resilient, with steady growth expected across key cities and regional areas. The economic outlook is stable, and trends suggest a positive environment for both homebuyers and investors. Here’s a concise overview of what to expect in 2025.

Economic Overview for FY25

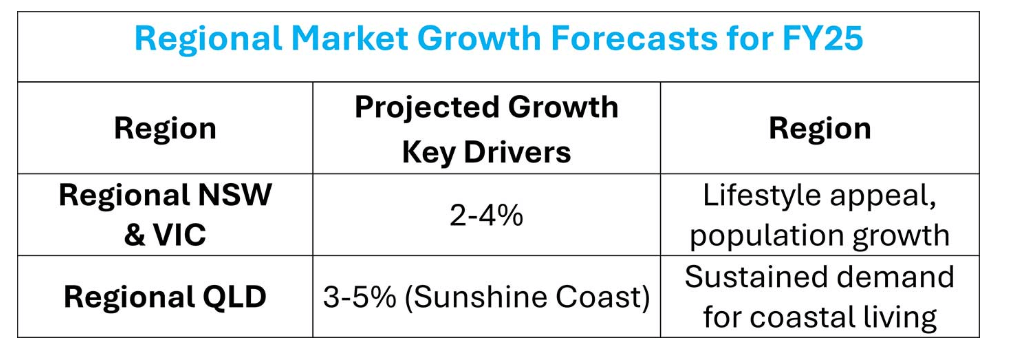

Regional Market Highlights for FY25

Australia’s regional property markets remain strong, attracting lifestyle-focused buyers and those seeking affordability. Key regions in New South Wales, Victoria, and Queensland are projected to experience solid growth in 2025, driven by demand for lifestyle properties. Areas like the Sunshine Coast and Geelong are seeing strong price increases as people leave major cities for more affordable and relaxed lifestyles.

Interest Rates and Inflation Impact

Recent data suggests that while headline inflation is within the RBA’s target range, core inflation remains higher, particularly in the services sector. This indicates the RBA may maintain high interest rates through 2025, keeping borrowing costs elevated for property investors. The stabilization of headline inflation is a positive sign for the broader economy, but higher rates may continue to dampen short-term property price growth.

For investors, sustained higher interest rates will be a key consideration. While borrowing costs will stay high, the broader economic stability and strong regional demand offer long-term opportunities for growth.

How Inflation is Affecting Household Spending

Inflation has had a significant impact on Australian spending patterns. Households are allocating more of their budgets to essentials like food, housing, and utilities, while spending on non-essentials has declined. There has been a noticeable increase in household debt, particularly credit card usage, as families manage higher costs. The gap between wage growth and inflation has reduced real income for many, impacting overall purchasing power.

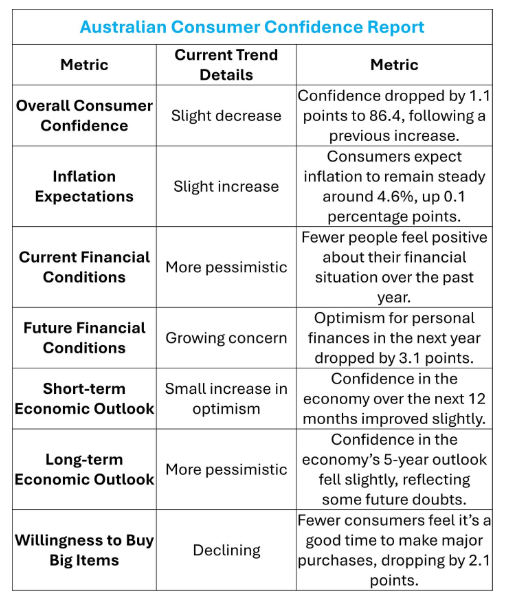

Consumer Sentiment: Shaping the Property Market

Recent consumer sentiment data shows improving confidence, particularly among renters and homeowners without mortgages, suggesting optimism about the future. Confidence levels are rising, driven by expectations of potential rate cuts or broader economic stability. In uncertain times, this shift in sentiment can influence property demand and market outcomes.

Outlook for 2025

Regional Growth: Strong demand for properties in regional areas like Queensland, New South Wales, and Victoria is expected to continue, driven by lifestyle choices and affordability.

Interest Rates: High interest rates are likely to remain, moderating property price growth in the short term but offering opportunities for investors focused on long-term gains.

Consumer Confidence: The boost in consumer sentiment suggests cautious optimism, which could lead to increased property demand.

Conclusion

Australia’s property market in 2025 looks set to experience steady growth, especially in regional markets. Despite high interest rates and inflationary pressures, the broader economic stability, combined with improving consumer sentiment, creates a resilient property environment. Investors and homebuyers should monitor these trends to make informed decisions as the year unfolds.