Australia's expanding elderly housing market

Australia’s aging population is driving the rapid expansion of the retirement living sector and the demand for aged care facilities.

- By 2066, there will be over 4.5 million Australians between the ages of 65 and 74; of these, almost 3.5 million will be between the ages of 75 and 84, and one in five will be 85 years of age or older.

- In the last five years, the retirement village industry has employed 29,000 people and brought in $5.4 billion in income, according to IBISWorld retirement village trends study. As operators build new projects to satisfy growing demand, the industry is expected to continue growing.

- Retirement living has traditionally comprised village layouts with meals served and care levels that varied according to the inhabitants’ age and health. However, the expectations of today’s retirees are different and higher regarding their living circumstances.

- As the affluent Baby Boomer generation retires, upscale and sought-after locales are becoming increasingly important in retirement planning. Retirees who want to stay in familiar neighborhoods and take advantage of city culture are increasingly choosing vertical high-density apartments in inner-city locations.

- Developers have profited from this trend by marketing luxury apartments with on-site amenities like restaurants, wine cellars, movie theaters, and golf simulators to wealthy downsizers.

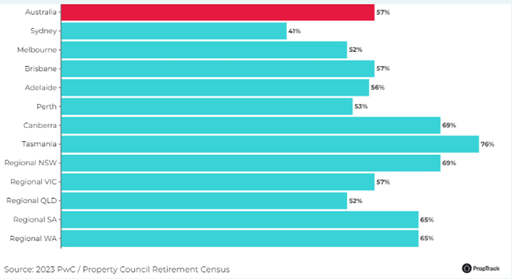

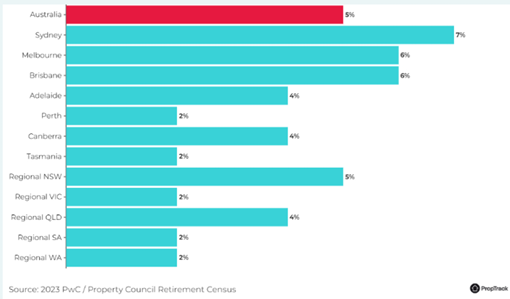

The median house price in the same postcode is to the average price of an independent two-bedroom flat.

The cost of retirement

- The majority of the retirement houses listed on realestate.com.au are priced between $350,000 and $640,000, with prices ranging from less than $100,000 to over $4 million.

- The average cost of a two-bedroom apartment in a retirement village is 43% less than residences in the same postcode across Australia, with an average price of $559,000 compared to the median house price of $986,000. This information comes from the 2023 PwC-Property Council Retirement Census.

- 59% of two-bedroom retirement homes in metro Sydney are less expensive than the median home price, providing retirees with a more cost-effective choice in one of the priciest cities in Australia.

The average age of the inhabitants in retirement communities

The mean age of residents in aged care is eighty years old, whereas the

average age of new entrants is seventy-five. This suggests that properties

targeting younger retirees between the ages of 55 and 75 are in demand. By

providing opulent residences in prime locations, developers can draw in this

group and encourage early retirement transitions. To accommodate healthier,

younger retirees, retirement development owners are taking a more detached

approach and offering in-home care as needed.

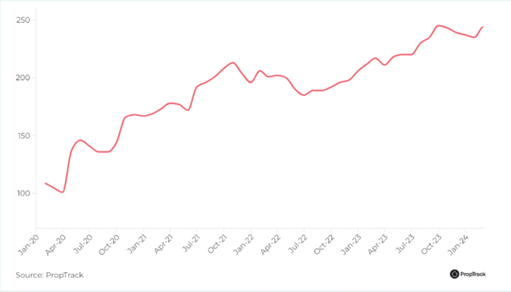

Realestate.com.au lists retirement developments. - National

For retirement developments, inquiries should be made via realestate.com.au - National

The three states with the highest concentration of development are NSW, VIC, and QLD with Victoria leading at 37 % NSW at 35%, and QLD at 23%. Since June 2020, retirement developments in Victoria have increased by 150%.

Nonetheless, during the previous four years, the number of retirement projects in ACT, NT, TAS, and SA has continuously been low.

Over the past year, there has been a notable surge in demand for retirement complexes, with inquiries rising by 15% across the country.

Property enquiries are highest in NSW and QLD and have risen by more than 30% in the last year.

Looking forward

Due to an aging population with changing expectations, Australia’s retirement living market is expanding rapidly. To appeal to younger retirees and affluent

downsizers, new developments now prioritize luxury and location.

For the market to keep up with the increasing demand, more properties must be made available despite the sector’s growth.