Essential Trends and Insights Defining the Real Estate Market- June,2024

The increase in property prices has slowed by the end of 2023. The number of new listings entering the market and the overall number of listings for sale were rising at and interest rates had just gone up but were predicted to have peaked.

Considering this, we anticipated when we made our earlier projections that the rate of increase in prices would slow down until interest rate and tax cuts started in the second half of this year.

As things stand right now, the amount of fresh goods entering the market has been steadily rising, expanding to include additional major cities, and increasing the total amount of products available for purchase.

Even though there is more inventory available for purchase, sales volumes have increased significantly as well, and as a result, the price rise has been stronger than expected in the first part of 2024. The market is holding up far better than we expected due to the prolonged halt in interest rates and increase in stock.

The preliminary sales count of homes advertised for sale on realestate.com.au is calculated monthly,

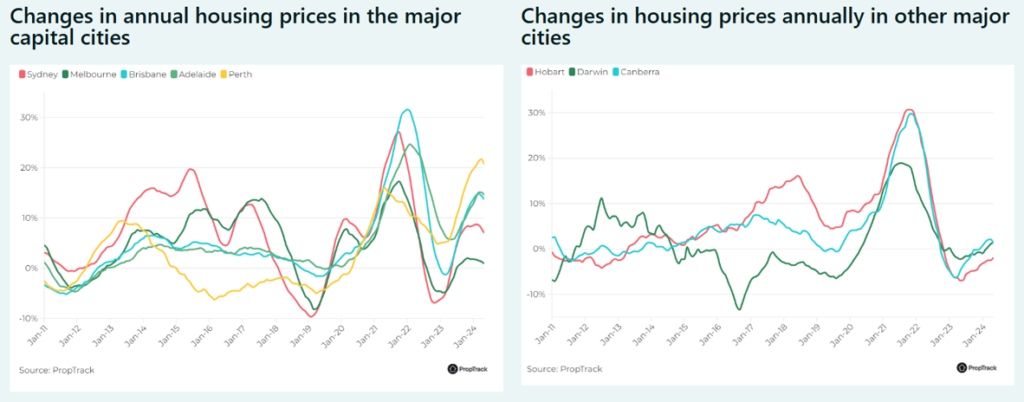

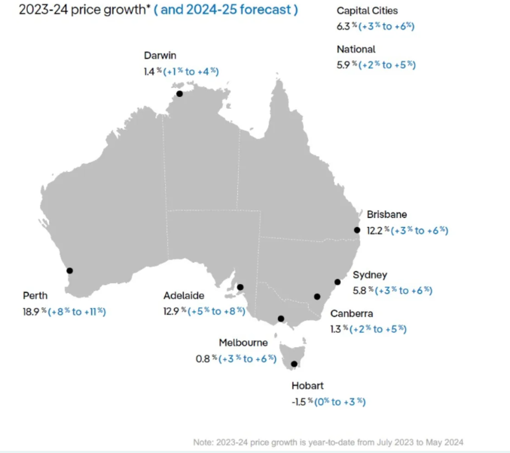

- From January to May of last year, prices grew by 2.7%, bringing the total increase in home prices for the 2023-24 fiscal year to 5.9%. In December of last year, we predicted that national home prices would grow by 1-4% in the 2024 calendar year….

- Despite increased interest rates, which now seem likely to last longer than initially anticipated, the market is resilient.

- Although rate cuts are still more likely than hikes, it appeared a few months ago that they would happen later this year. However, it is anticipated that rate reduction won’t start until the first half of 2025. Reductions in borrowing capacity will occur from interest rates staying higher for an extended period.

- Sales volumes have demonstrated strength over the first five months of 2024, with national volumes 13.9% higher than during the same period the previous year.

- Sales have increased year over year in every capital city and the remaining state area, except Hobart and the rural Northern Territory. Sydney, Melbourne, and Darwin have had the most increases in sales volumes. Canberra and Sydney are the other two capital city regions that have seen the biggest increases in stock available for purchase.

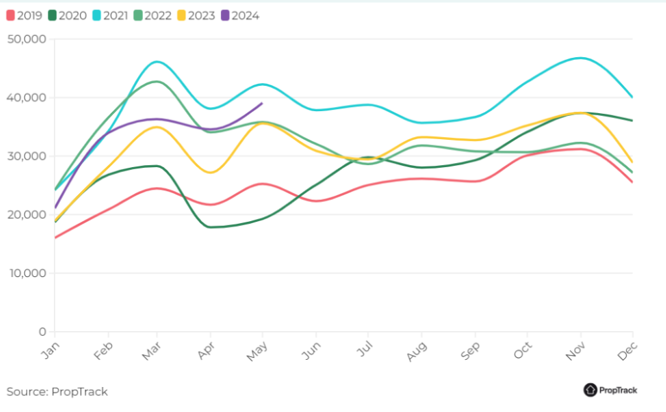

New listings for sale every month, nationwide

May 2024 saw an 8.2% increase in the total number of homes up for sale when compared to the same month the previous year. This suggests that despite consumers having more options in the market, sales volumes have increased.

Sydney, Melbourne, and Canberra have experienced the biggest increases in new listing volumes, demonstrating how eager buyers have been to make a purchase has matched sellers’ eagerness to list. In the majority of other markets, we are also beginning to witness a rise in newly listed properties.

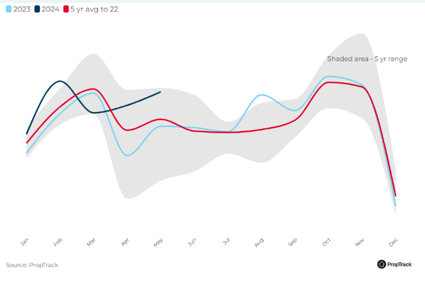

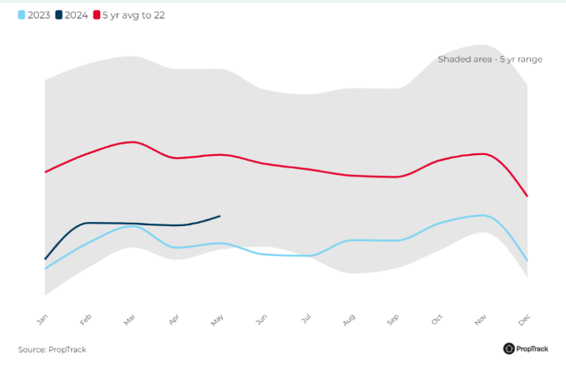

Monthly total of National sale listings

Despite a rise in the volume of stock for sale over the past year, buyer interest remains high. Inquiries per listing have decreased by 6.3% compared to last year but are still elevated. In May 2024, properties spent a median of 38 days on the market, down from 43 days a year ago. Stable interest rates since November have bolstered market activity, although rate cuts are now expected in 2025. Since the pandemic, home prices have risen by 42.1%, driving equity gains and encouraging owners to upgrade. However, financial stress from higher interest rates might push some owners to sell and opt for cheaper properties.

Variation in the projected resident population annually

Australia’s population is growing quickly, which is driving up housing demand The country’s population grew by 659,795 during the 12 months ending in September 2023-a record-high 2.5% annual growth. 548,770 of this increase’s population came from net foreign migration, the majority of whom needed homes when they arrived.

The robustness of the home demand in spite of the poor state of consumer confidence is also noteworthy. The longest period of time since the early 1990s has seen a greater proportion of pessimism than optimism for 27 straight months, according to the Westpac-Melbourne Institute Consumer Sentiment index.

It's time to purchase an index home.Countrywide

In a similar vein, the Westpac-Melbourne Institute Time to Buy a Dwelling Index has demonstrated a 36-month trend of pessimism over optimism, suggesting that consumers do not think this is the best time to make a purchase. However, the house price expectations index for Westpac-Melbourne Institute is currently at a high not seen since mid-2021, when interest rates were still at all-time lows.

What's in store for the rest of 2024?

We are updating our estimates for price growth in 2024 in light of the trajectory of home price rise. As of right now, we anticipate that prices will rise by 2% to 5% in the current year.

Due in large part to the strong price growth momentum in these markets, the low number of stock available for sale, and the boost from income tax outs starting In the middle of this year, we have increased our projection for price changes in Darwin, Brisbane, Adelaide, Perth, Canberra, and Darwin this year.

Sydney and Melbourne’s price growth projections are essentially unchanged, although we think they are more likely to be on the higher end of our forecasts.

If these price rises materialize, they will do so at a slower rate than what was observed in 2023, but with higher increases in sore major oles.

Forecasting price growth in the housing market for the next 12 months presents challenges. Despite interest rates at a 12-year high and increased stock for sale, prices are rising faster than expected. Recent months have shown a slowdown in price growth alongside higher inflation, delaying anticipated interest rate cuts from September to mid to late 2025. The role of rate cut expectations in boosting buyer confidence suggests that postponing cuts could dampen activity and prompt sales due to financial strain Conversely, Stage 3 tax cuts from mid-2024 are expected to boost disposable incomes and borrowing capacities, potentially equating to two 25-basis point rate cuts and inflating housing prices further. Heading into early 2025, closer anticipated interest rate cuts might stimulate buyer demand and price hikes. Despite a weaker labor market and subdued new dwelling starts. This scenario is key to maintaining tight rental markets, driving more renters towards homeownership, particularly with impending rate cuts.

Conclusion

By the conclusion of the 2024-25 fiscal year, we anticipate slightly stronger price increase than we anticipate at the end of the current calendar year, with a shit in the growth profile. While price growth in certain capital cities is predicted to decelerate, i is anticipated to pick up in Sydney and Melboume, two of the largest marketplaces

Unexpected events, such as dramatic shifts in the number of properties available for purchase or moditications to the supply of new housing, which we anticipate to stay modest, could have an influence on these projections.

These could also be impacted by govemment intervention in the market, such as significant increases in house buyer assistance or modifications to the tan classification of investment homes, as we’ve seen in some states.