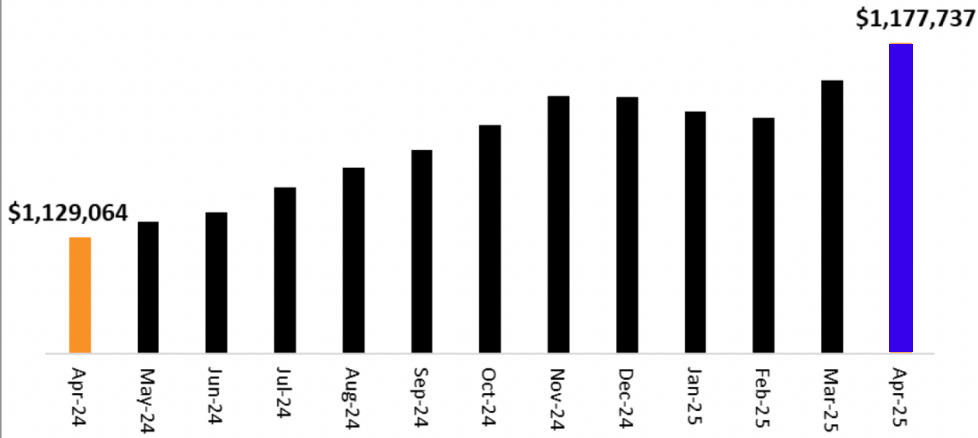

Home Prices Rise in April as Lower Rates Rekindle Buyer Demand

Australia’s housing industry is gaining traction due to demand and affordability. Following the first interest rate drop in over four years, Australia’s housing market continued to rise in April due to increased affordability and buyer confidence. Both the capital city and regional markets had robust results as national home values increased for the second consecutive month. The national median house price in capital cities increased by 0.8% in April to $1,177,737, according to current data. This maintains the upward trend that started in March and represents the equal biggest monthly growth since April 2024.

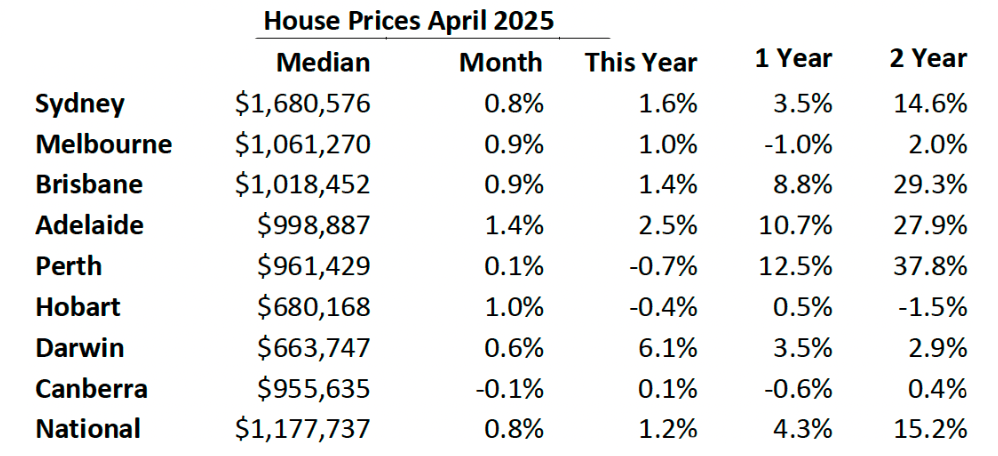

City-by-City Overview: Excellent Overall Performance

Except Canberra, all capital cities recorded rising home prices in April. Melbourne and Brisbane both showed positive signs of recovery, while Adelaide and Hobart were the best monthly performers.

House prices in Adelaide (+10.7%), Brisbane (+8.8%), and Perth (+12.5%) have increased dramatically over the past year, indicating sustained demand outside of the two biggest cities. However, Melbourne and Canberra saw slight yearly decreases of -0.6% and -1.0%, respectively.

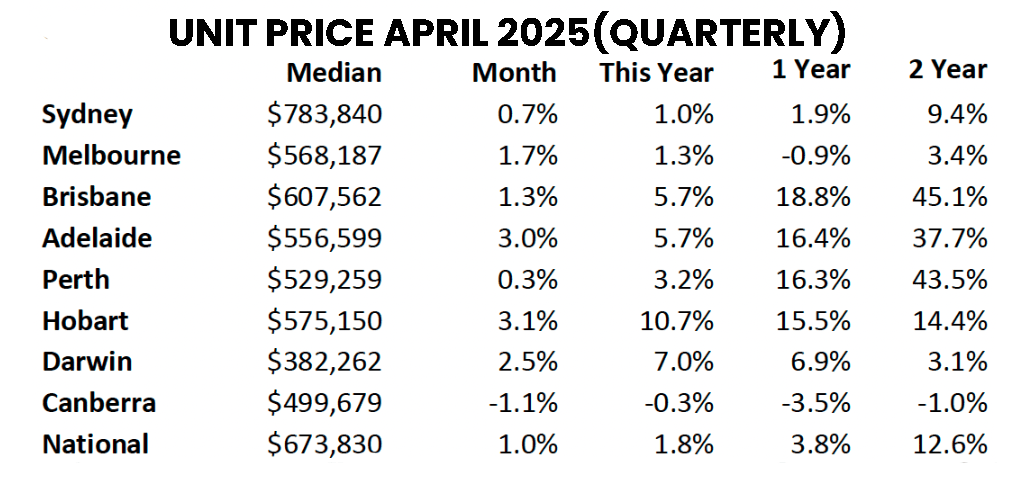

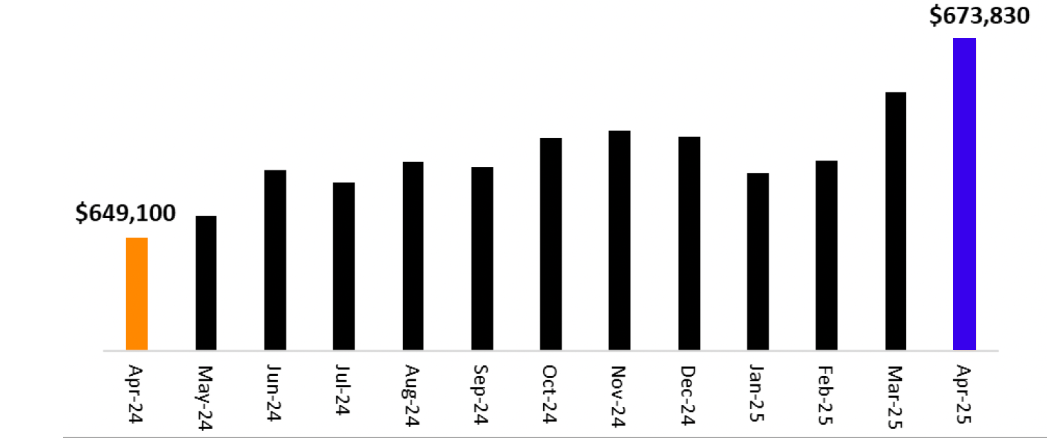

Quarterly Unit Growth Is Strong, Particularly in Smaller Capitals

Additionally, unit prices increased 1.0% nationally during the April quarter to a median of $673,830, illustrating the growing affordability issues in the detached home market.

With the highest annual unit price growth in Brisbane (+18.8%), Adelaide (+16.4%), Perth (+16.3%), and Hobart (+15.5%), medium-density housing alternatives are becoming increasingly popular

Confidence Rebounds as Cost Decreases

Buyer confidence and affordability increased after the interest rate drop in February. This has been a major factor in improving market activity and sentiment in the majority of capitals. Reduced borrowing costs have increased the accessibility of real estate, particularly for first-time homebuyers and long-term investors.

The market appears to have gotten past its typical slow start to the year and is currently gathering steady speed, according to April’s data, according to market watchers.

High demand and limited supply continue to dominate the market.

Demand is increasing, but there is still a severe shortage of new homes available:

- New home starts are 16.5% lower than the decade average.

- Building prices are rising, which makes new projects less feasible.

- As vacancy rates in rental properties narrow, rentals rise, and investor interest rises.

The pressure on selling prices and rentals is expected to persist for the rest of 2025 due to continuous migration and limited building activity, even if population growth has just slowed.

Looking Ahead: 2025: A Moderately Positive Outlook

In general, the housing market’s forecast for 2025 is still positive, even if growth is anticipated to be slower than in 2024.

Among the main forces behind the ongoing expansion are:

- The possibility of further reductions in interest rates

- Better affordability as a result of cheaper financing

- Post-election incentives for first-time homebuyers are anticipated.

- Constant shortage of new homes.

But affordability is still a big problem. A significant portion of income is still spent on mortgage repayments, and many households still need more than ten years to save a deposit. It’s unlikely that prices will drop much if supply doesn’t expand.

Conclusion

Australia’s housing market’s resilience was confirmed in April. The restricted housing supply and lower interest rates are supporting price increases in most cities, despite local affordability limits and global uncertainty.Although the pace may slow down a bit over the next several months, all indications suggest that the real estate market is still strong, especially in cities like Adelaide, Brisbane, and Melbourne, which are currently experiencing a resurgence in activity.