May saw a record high for national housing prices | New Proptrack Report

Principal conclusions

May saw a 0.3% increase in national home prices, setting a new high.

With prices up 9.58% from their December 2022 low, they are currently 6.68% over May 2023 levels.

Strong population growth, competitive rental markets, and improvements in home equity all contributed to demand but the supply side of the housing market

could not keep up, as seen by the 17th consecutive month of increases in national home prices despite an increase in the number of properties for sale this year.

This year’s strong population growth, competitive rental markets, and advances in home equity have all contributed to high demand for homes, even in spite of

an increase in the available inventory.

In the meantime, capacity limitations and rising costs continue to hinder building activity, which leads to a shortage of homes, which drives up prices and rents.

The normally quieter winter months will probably see the growth rate continuing to slow down, especially as interest rate cut predictions have been pushed out

until late 2025.

According to the latest PropTrack Home Price Index Report, strong population growth, competitive rental markets, and gains in home equity have all contributed

to demand while the supply side of the housing market has lagged. As a result, national home prices have increased for 17 months in a row, having risen 0.3% to

set a new record in May.

As a result, home prices have increased by 2.73% so far this year.

- As of right moment, prices are up 9.58% from their December 2022 low and 6.68% over May 2023 levels. Strong demand is still supported by tight rental markets, robust population growth, and advances in home equity, even if there are more properties for sale this year.

- Constrained capacity and increased costs continue to hinder building activity, which in turn drives up prices and rentals due to a shortage of available homes. Due to the mismatch between supply and demand, home prices are still rising despite the impact of affordability limits and the current climate of increasing interest rates.

- In the upcoming months, housing prices are predicted to rise even further, despite a slight slowdown in the rate of population growth and an increase in the

amount of stock available for purchase. - Nonetheless, given that interest rate decrease forecasts have been postponed until late 2025, it is anticipated that the growth rate will continue to slow

throughout the traditionally quieter winter period.

Key conclusions from the Proptrack report released in May 2024:

- Prices for single-family homes nationwide increased by 0.30% in May to set a new high and increase prices by 2.73% so far this year. At their December

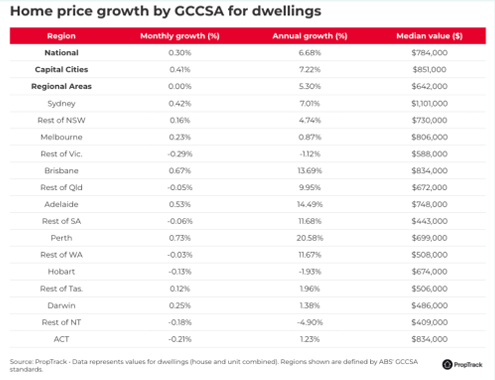

2022 low, prices had increased by 9.58%, and they are 6.68% above levels as of May 2023. - May saw a new peak in prices across the combined capital cities, up 0.41%. Currently, capital city prices have risen 7.22% from the previous year, however regional and capital performance varies.

- Though the rate of increase in property prices has slowed since the end of summer in every capital city, prices increased in May in all but Hobart (-0.13%)

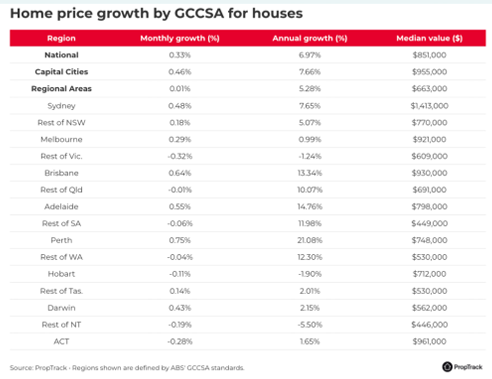

and Canberra (-0.21%). - Adelaide (+0.53%), Brisbane (+0.67%), and Perth (+0.73%) had the highest rate of price increases in May. These markets continue to have the biggest yearly growth, with Perth prices up 20.58% over the previous year, and Adelaide and Brisbane rising 14.49% and 13.69%, respectively. These trends have been evident for the better part of the last two years.

Prices in Brisbane have risen by 18.15% from its December 2022 low, making it the second most expensive capital after Canberra, and for the first time since 2009, more expensive than Melbourne. This comes after a period of persistently high growth.

Over the past year, capital city prices have surpassed those of regional communities. Prices in the combined regional areas were unchanged in May, while the only regional markets to experience price growth were regional Tasmania (+0.12%) and regional NSW (+0.16%).

According to Ms. Creagh,

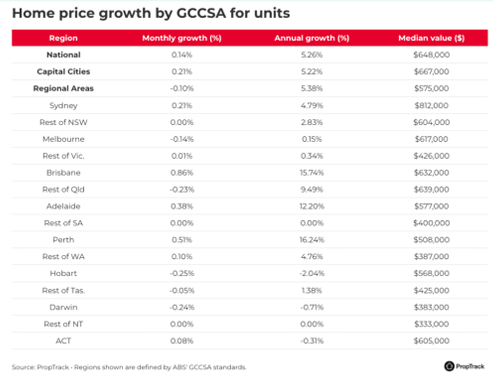

House values have grown quickly, up 46.9% from pre-pandemic levels, while unit values have grown more moderately, up just 22.6% from pre-pandemic levels. This is consistent with the trend observed throughout the pandemic. The last few years have seen a two-speed market in terms of home value growth. Although houses usually command a premium over apartments, and in the long run, houses tend to outperform apartments in terms of price growth, since the pandemic began, house price outperformance has reached historically high levels.

Perspective

Home values in 2023 managed to withstand the climate of rising borrowing rates, and in 2024, these improved conditions from 2023 have persisted.

Ms. Creagh clarified.

- Since there isn’t enough housing supply to fulfill demand nationwide, home prices have continued to rise and reached a new high in May. This is likely due in part to the steady interest rate environment, which has encouraged confidence in both buyers and sellers.

- But in all major cities, the rate of increase in housing prices has decelerated from the faster rate observed during the summer selling season.

Increased inflation and interest rates are making household budgets more difficult, and many people are still worried about the direction the economy is going. However, with population growth, competitive rental markets, rising home equity, and a stable environment for interest rates, it is anticipated that property values will rise even higher this year. - Even said, rising housing prices are probably encouraging a lot of people to overcome affordability issues and conduct business with the hope of future

appreciation. - The housing market’s supply side hasn’t been able to keep up with the significant demand, though. Exacerbating the shortage of home supply is the decade-low levels of building activity.

- Further price increases are anticipated as a result of this supply and demand imbalance, which has counteracted the environment of rising interest rates and declining affordability.

- Even if the rate of population growth has somewhat slowed down and there is more stock available, house prices are predicted to rise even higher in the coming months.

- However, given that interest rate decrease forecasts have been postponed until late 2025, it is anticipated that the growth rate will continue to slow over the

traditionally quieter winter time. Because of intense competition from extremely low stock levels and strong buyer demand, the smaller capital city markets of Perth, Adelaide, and Brisbane are likely to continue to succeed even while growth is slowing down.