The 2025 REA Group Rental Affordability Report: Rental Difficulties in Australia

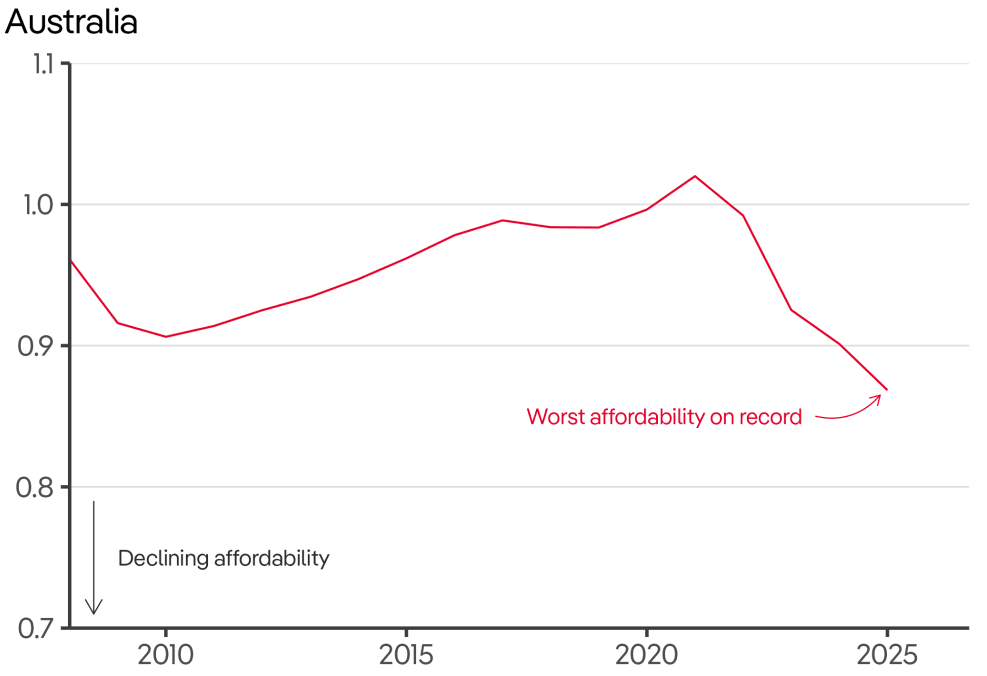

As per the PropTrack Rental Affordability Index, the rental market in Australia has experienced its most affordable level in at least eighteen years. Rising rents over the last few years, combined with wage growth that hasn’t kept up, have contributed to the decline in renting conditions. Because of this, many renters—especially those with lower incomes—are dealing with previously unheard-of affordability issues. In 2024, there are indications that the rental market may be beginning to improve.

A Record Low in Rental Affordability

According to the most recent report, rental affordability in Australia has hit its lowest point ever. According to the PropTrack Rental Affordability Index, households could afford the smallest percentage of advertised rentals during the six months from July to December 2024 since records were kept in 2008. Even though rent growth slowed in 2024, it still exceeded income growth, making affordability problems worse.

Impact on the Nation: Renters in almost every state are now facing far higher rent burdens as a result of Australia’s dramatic decline in rental affordability.

Pre-pandemic to Present Situation: Rental affordability was higher prior to and during the pandemic, with a discernible improvement from the late 2010s to 2020–21.But these gains were swiftly undone by the pandemic’s effects on supply and demand, which resulted in a sharp increase in rents throughout a large portion of the nation.

Trends in Regional Rental Affordability

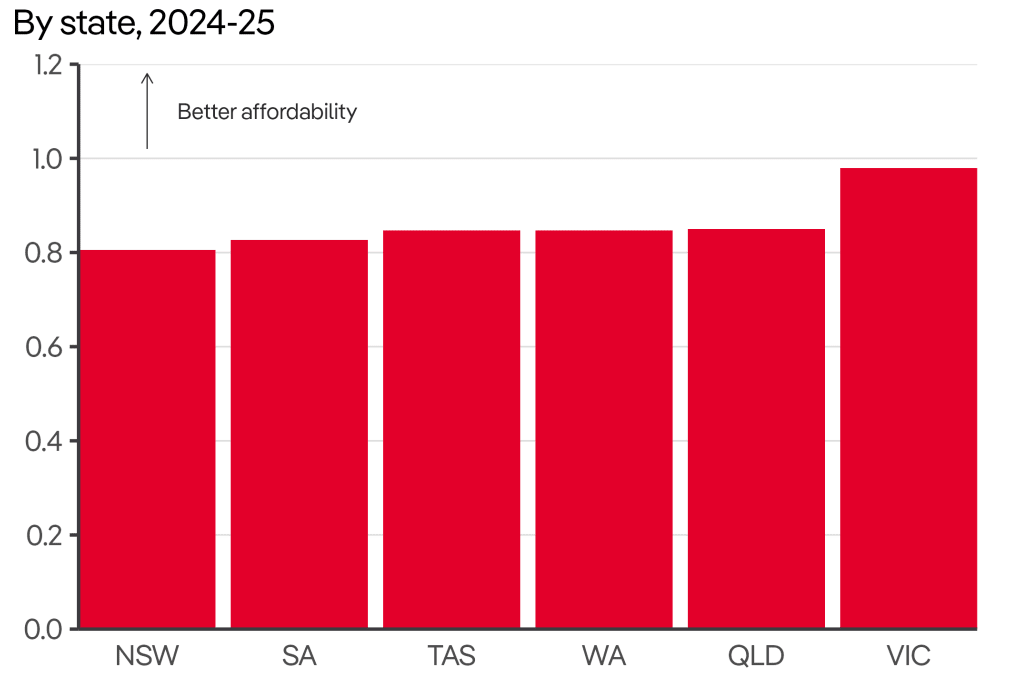

The majority of Australian states have seen a decline in rental affordability, although how this problem is impacting various areas varies significantly.

- New South Wales (NSW): For the majority of the previous eighteen years, NSW has been the state with the highest rental costs. With typical rentals of $780 for homes and $700 for apartments, Sydney continues to have among the highest rates in the nation. The state continues to be the most difficult rental market for tenants, even though rental affordability hasn’t declined as precipitously as in other states.

- South Australia: Once one of the cheapest states, South Australia is currently the second most expensive for renters. Before the pandemic, South Australia was one of the cheapest states, thus this represents a significant change. Renters in the area are under stress as a result of the sharp rent increase.

- Victoria: Only a few years ago, Victoria was the second-least cheap state for renters; now, it is the most affordable state. By the end of 2024, Melbourne will have the second-cheapest median rent in Australia, at $570 per week. Although rentals have risen by 32% since March 2020, this is still significantly less than the 48% national average, and rent growth in Melbourne has been far less than in other cities.

Renters with Low Incomes Can Afford It

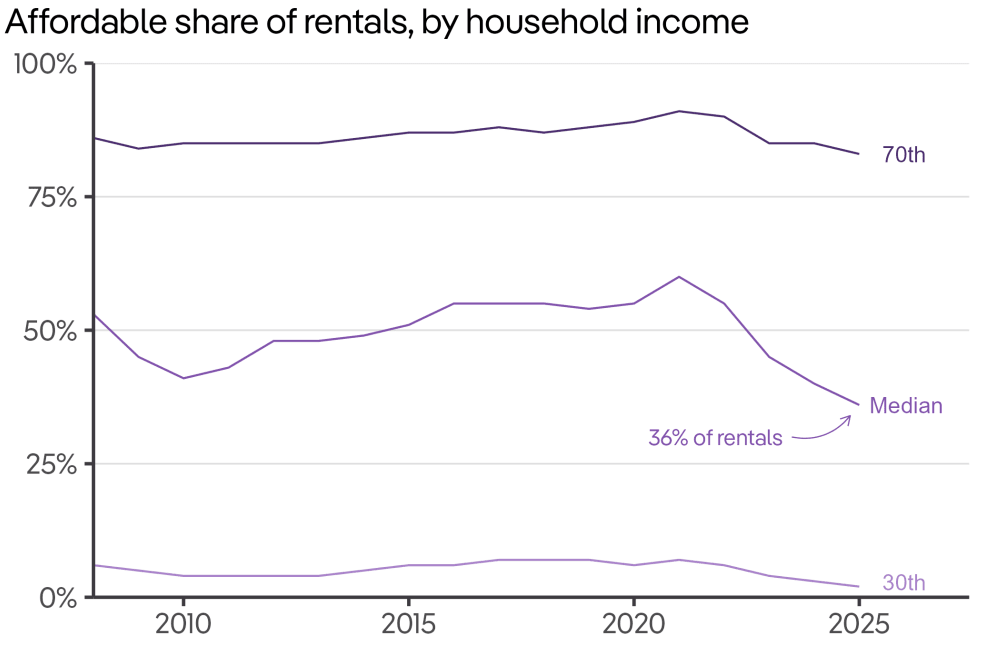

For low-income tenants, the rental affordability situation is especially difficult. The ability of households with typical Australian incomes of $116,000 to afford rental houses has significantly declined. Such households could only afford 36% of all rental ads in the second half of 2024, which is the lowest percentage since statistics have been kept. Compared to 2020–21, when median-income households could afford 60% of rentals, this is a significant drop.

Top 30% Income homes: It’s getting more difficult for even the homes in the top 30% of Australians, who make around $177,000. These households could only afford 83% of rental prices in 2024–2025, compared to 78% in New South Wales and 91% in Victoria.

Trends in Rent Growth and Rental Availability

Notwithstanding the affordability issues, there are indications that the rental market might be beginning to level off:

Rental Availability: In 2024, rental availability improved, particularly in capital cities, indicating that the severe supply constraints might be abating.

Slower Rent increase: Although still robust, rent increase in 2024 was less rapid than that of 2022 and 2023. In 2025, this tendency is anticipated to continue, which might offer some respite to tenants.

Conclusion

In comparison to the last few months of 2024, clearance rates had also improved in February in all capital cities. Due to the minor improvement in affordability and buyer confidence, which will drive renewed demand and price rise, the price declines that have occurred over the last two months are therefore likely to be temporary and may even reverse. The price increase may be more subdued than in prior easing cycles because housing affordability is at its lowest point in thirty years. Since this rate-cutting cycle is anticipated to be brief, the rate of increase in home prices will lag behind the robust performance of the previous several years.